-

dfcu Back to School ‘School Fiiz! Weight Off’ Campaign 2026.

Everything You Need to Know About the School Fiiz Weight Off! Campaign

Frequently Asked Questions

1. What is the “School Fiiz Weight Off!” campaign about?

The “School Fiiz Weight Off!” campaign is an integrated campaign that is targeting parents, guardians, schools, students, and education suppliers. It offers a variety of school payment channels and tailored financial solutions to ease school fees collection and reduce the financial and emotional burden of school fees, while promoting financial inclusion and literacy.

We are addressing the entire education ecosystem to drive transactional growth, deepen customer engagement, and position dfcu as the leading financial partner for parents, schools, and the wider education ecosystem.

2. Who is eligible to participate?

Campaign is open to all schools and parents that pay school fees through dfcu or parents/Guardians that will borrow from dfcu during the campaign period.

3. How do I participate in the campaign?

To participate:

- Schools: Schools need to grow their school fees collection through dfcu by 20% not less than Ugx 500M for Kampala schools and Ugx 300M for Upcountry schools or takes up a bancassurance policy during the campaign period.

- Parents: Parents should pay their school fees through dfcu Bank (school fees payment of not less than UGX 300,000) or borrow during the campaign period (net take-home of not less than UGX 15 million.)

4. Is the campaign available nationwide?

Yes, the campaign is open to all schools and parents that pay schools fees through dfcu or borrow from dfcu across the country during the campaign period.

5. Can I pay fees for multiple children and still qualify?

Yes, payments for multiple children or multiple institutions qualify as separate entries, increasing your chances of winning.

6. How long is the campaign running?

The campaign, along with the rewards attached to it will run for three months and customers are encouraged to act quickly to take advantage of the special offers.

Post campaign, customers can continue to borrow from dfcu to meet various personal and business cash flow needs.

School Fees Payment1. How do I pay school fees?

Customers can pay school fees through our different convenient channels and schools fees payment platforms i.e. dfcu QuickApp, USSD *240#, dfcu Agents, dfcu Branches, SchoolPay, SurePay and Pegpay.

Loan Products and Features

1. What types of loans are available under this campaign?

i.Unsecured Personal Loans: Up to UGX 400M, reduced interest rates, and repayment holidays.

ii. dfcu Mobi-Loan: Up to UGX 5M at affordable rates.

iii. School Owners’ Financing: Up to UGX 500M unsecured loans.

iv. Vehicle & Asset Financing: Up to 100% financing with flexible repayment options and discounted interest rates.

v. LPO Financing offer: 70% financing at affordable interest rates.

2. What is the repayment period for the Unsecured Personal Loan?

Repayment terms extend up to 120 months, with a repayment holiday option of up to two months.

i. How can I apply for a loan?

Customers can visit any dfcu Bank branch or contact their Relationship Manager for assistance. For dfcu Mobi-Loans, simply dial *240# for quick access and follow the prompts or log onto the Quick Banking platform to access the loan.

ii. How long does it take to process a School Bridge loan?

Loans can be processed within 24 hours for qualifying customers.

Insurance Products

1. What is Schools Comprehensive Cover?

Schools Comprehensive Insurance Cover is a policy that provides broad protection for a school’s property, vehicles, staff, students, and legal liabilities against losses arising from accidents, damage, theft, fire, injuries, or claims made by third parties.

2. What is School Motor Comprehensive Policy?

School Motor Comprehensive Insurance is a motor insurance policy specifically designed for vehicles owned (or used) by a school that offers the broadest level of protection. It combines the usual legal liability cover with extensive protection for the school’s vehicles themselves. The scope covers:

- Accidental damage to the school bus,

- 3rd party Liability,

- Fire damage

- Theft and burglary

- Natural perils,

- Passenger liability (Students and Staff onboard)

- Windscreen and glass damage etc.

Rewards

1. Library Stock Up.

A school that increases its school fees collections by 20% and borrows from dfcu Bank or switches its school fees collection to dfcu Bank with school fess collections not less than UGX 500,000,000 for Kampala schools and UGX 300,000,000 for upcountry schools or takes up a Bancassurance Policy during the campaign period stands a chance to win Library Stock Up worth UGX 5,000,000.

2. Parents’ Cash Reward.

We shall reward the first 15 parents up to UGX 500,000 each week, should they pay school fees through dfcu Bank (school fees payment of not less than UGX 300,000) or borrow during the campaign period (net take-home of not less than UGX 15 million.)

The 15 winners per week include 5 winners for school fees payment and 10 winners for borrowing. Overall, rewarding 195 winners throughout the campaign period.

The customers who pay school fees through dfcu will win UGX 150,000 whereas customers who borrow, will win tiered rewards, as per summary below.

Borrowing Tiers (UGX) Rewards (UGX) 15M – 24.9M 200,000 25M – 49.9M 300,000 50M – 99.9M 400,000 100M – 400M 500,000 3. How will the winners be selected?

The first 15 customers who pay school fees or borrow through dfcu will win up to UGX 500,000 each week.

4. How will customers know if they have won?

- Winners will be contacted directly by dfcu bank via 0800 222 000 / 0800 777 000.

- They will need to present a valid national ID/passport at a dfcu Bank branch for verification.

- Cash rewards will be deposited into their preferred dfcu Bank account.

- Winner announcements will also be made via dfcu official communication channels.

Customer Support

1. Who can I contact for more information?

For inquiries:

Call: 0800 222 000 / 0800 777 000

Email: customercare@dfcugroup.com

WhatsApp: +256 776 760 760

dfcu Bank – Going Further, Together

-

Teeka Ku Card Campaign with dfcu Visa Card FAQs

EVERYTHING YOU NEED TO KNOW ABOUT “TEEKA KU CARD” CAMPAIGN

- What Is The “Teeka Ku Card” Campaign?

The Teeka Ku Card campaign is here to make our customers spending lighter, when they use their dfcu Visa Card for their everyday transactions.

Our customers not only get rewarded for using their dfcu Visa Card, but they also get to enjoy easier, safer and faster transactions while making payments for their goods and services both online and at any location with a POS machine countrywide and international.

It’s our way of saying thank you for going cashless with us this festive season.

- Who Can Participate?

- All dfcu Bank customers with active dfcu Visa Debit and Credit Cards (Classic, Gold, Platinum).

- Customers who hold an active dfcu Bank account.

- How Does One Qualify for the Cashback?

A customer who spends UGX 500,000 monthly with their dfcu Visa Card via gets a cashback of UGX 40,000.

- Is The Monthly UGX 500,000 a One-Off Transaction?

The UGX 500,000 should be an amount spent above UGX 150,000, equalling to UGX 500,000 spent by the customer in a month. Customers are encouraged to use their dfcu Visa Cards as often as they can while making payments for their goods and services both online and at any location with a POS machine countrywide and international, to enjoy these benefits.

- When Is the Cashback Received?

The UGX 40,000 cashback is credited onto the customer’s dfcu account at the end of the month.

- For inquiries on card issuance, renewal or reporting card related issues:

We’re here for you!

- Call: 0800 222 000 / 0800 777 000

- Email: customercare@dfcugroup.com

- WhatsApp: +256 776 760 760

-

dfcu Bank USSD – Comprehensive FAQs

A. General Information

- What is the new USSD update about?

The update simplifies USSD banking with:

- A user-friendly menu.

- A new 5-digit M-PIN (replacing app/web passwords).

- Free access (zero-rated – no charges for *240#).

- New features like standing orders, loan services (Mobi-loan, Mo-stock loan), self-onboarding, PIN reset

- Is the USSD code *240# changing?

No, customers and staff will continue using the same code: *240#.

- What mobile phones support the new USSD service?

All feature & smart phones, including basic phones without internet.

B. Registration & Security

4. How do I register to use *240#?

- Dial *240# → Select language (English/Luganda/Runyakitara/Luo/Lugbara).

- Choose “Yes” to register → Accept Terms & Conditions.

- Enter Account Number + NIN/Passport.

- Create & confirm a 5-digit M-PIN.

- You’ll receive a confirmation SMS.

5. What do I do if I forget my PIN?

- Dial *240# → My Accounts → PIN Management → Forgot PIN → Read and Accept Terms and Conditions.

- Enter National Identification Number (NIN)/Passport Number + Date of Birth → Answer Security Question.

- Create a new M-PIN.

6. Can I change my PIN when I want?

Yes:

- Dial *240# → My Accounts → PIN Management → Reset PIN → Read and Accept Terms and Conditions.

- Enter old PIN → Create new PIN.

7. Is the new USSD system secure?

Yes! It uses:

- 5-digit M-PIN (no complex passwords).

- Security questions for PIN recovery.

C. Features & Services

8. What can I do with the updated *240#?

- My Accounts: Check balance, mini-statement, link/delink accounts, manage standing orders.

- Send Money: To mobile wallets, other dfcu accounts, or other banks.

- Pay Bills: Water, electricity, DSTV, URA, NSSF, GOTv & DSTv,

- Pay School Fees: SchoolPay, SurePay, ZeePay

- Buy Airtime/Data: For MTN & Airtel (self or others).

- Loans: Mobi loans & Mo-stock loans.

- Float Purchase: For MTN, Airtel, and Pay way agents.

- My Approvals: Manage pending transaction approvals.

9. Do I need airtime to access *240# now?

No! Zero-rating means no airtime charges for using *240#.

D. Troubleshooting & Support

10. What should I do if a transaction doesn’t go through?

- Ensure the M-PIN is correct and account has sufficient balance.

- Check the transaction status under My Accounts → Mini Statement.

- If issues persist, contact:

- Customer Care: 0200 504200

- Toll-Free Help Line: 0800 222000 / 0800 203206

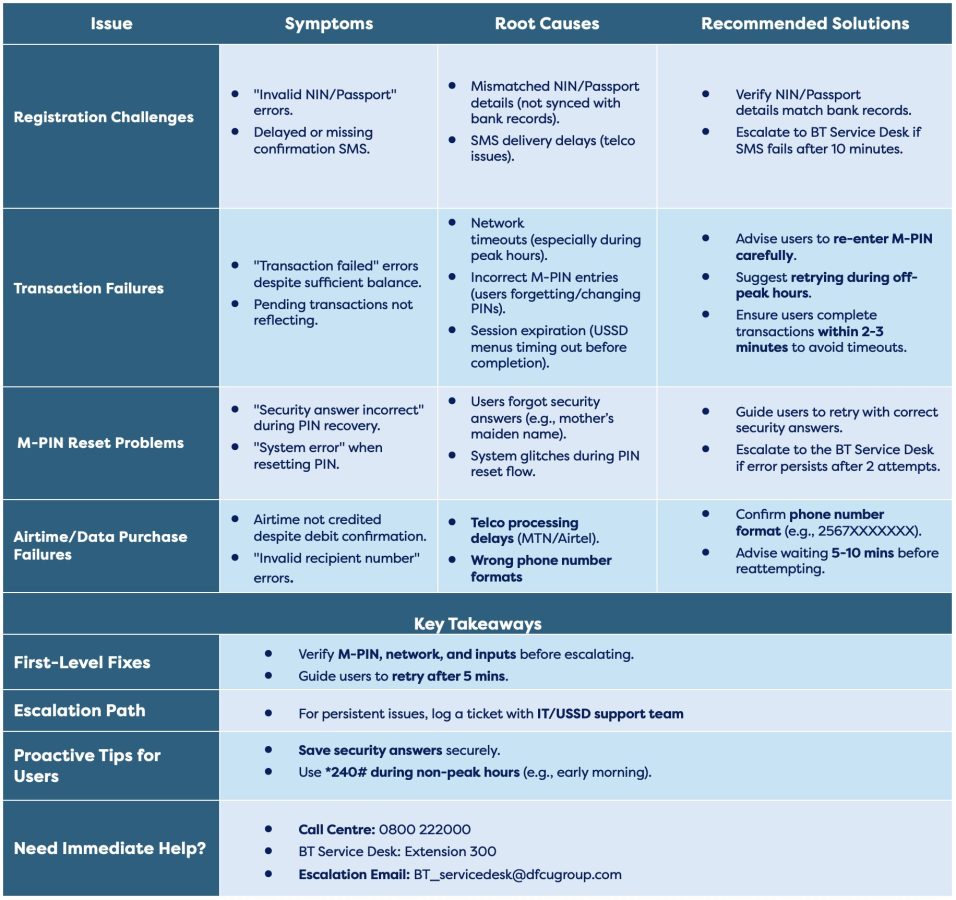

11. What are the most common issues a user could experience?

- Common issues:

- Incorrect inputs (verify account numbers, PINs).

- Network timeouts (ensure stable connection).

12. How is this better than the old USSD system?

- Simpler: M-PIN replaces complex passwords.

- Enjoy additional features: Loans, float purchases, Account Management.

- Free to use: No airtime charges.

- 24/7 availability with better stability.

13. What if I have more than one account—can I access all of them?

Yes! You can link or unlink multiple dfcu accounts using the *240# menu:

To link or delink an account:

- Dial *240# → My Account → Link/Delink Account → Answer security question → Enter account number and enter PIN to confirm

14. What if my transaction is stuck waiting for approval?

- Check My Approvals for pending requests.

- Ensure security questions/PIN are correctly entered.

- Escalate to customer care/Service Desk

F. Need More Help?

- Dial *240# for USSD menu.

- Call Toll-Free: 0800 222000.

- Visit a dfcu branch for in-person support.

Thank you for choosing dfcu Bank!

Common Issues

-

dfcu Bank Standard Terms and Conditions

1. DEFINITIONS

“Account” means a bank account in Uganda Shillings or in foreign currency maintained by the Customer with dfcu Bank.

“Agent” means any person authorised by the Customer or Authorised signatory to receive and collect payments or effect transactions in any form acceptable by the Bank;

“Bank” means dfcu Bank Limited;

“Business day” means any day on which the Bank is open for business in Uganda;

“Customer” shall mean a person who using the Bank services and includes natural and juridical persons, associations or community-based organisations.

‘‘Cut-off time” means the time after which transactions will be accounted for on the next business day.

“E-banking” means and includes; electronic banking, Interactive Voice Response, Quick banking, mobile banking, telephone and any other electronic banking service offered by the Bank.

“Instrument” means any payment instrument and includes but is not limited to cheques, standing orders, RTGS, EFTs or any other financial instrument.

“Mandate” shall mean the extent of authority of the Customer or its agents to operate an account;

“Related Parties” means and includes Customers who operate separate accounts but have a common financial interest, ownership, directorship, or shareholding or any other common interest. “Service/s” means and includes any service offered by the Bank.

“Special Terms and Conditions” means the terms and conditions that may be published by the Bank from time to time in relationship to a specific product and / or service on offer by the Bank.

“System” means and includes any electronic, digital, signal, computer or computer programme, telephone or any other device or gadget used to access e–banking.

“System Identity” means any number, sign, password, or code used to access e-banking;

2.0 AGREEMENT

2.1 These Terms and Conditions apply to all services offered by the Bank and apply immediately upon, signing up, registration or once the services are accessed. By signing this Agreement and signing up for any service or product on offer, the Customer is deemed to have notice of all the special terms and conditions that apply to the respective product or service.

2.2. Any service offered by the Bank may be modified, replaced or withdrawn at any time upon issuance of the requisite 30 (thirty) days’ notice to the Customer through the media or customer’s last known address or through appropriate display, in which event the Bank shall incur no liability whatsoever.

2.3. There is a cooling off period of ten working days from the date of application or signing up for the Bank services within which the Customer may revoke or terminate this This right is exercisable at any time within the above mentioned ten days by which period any money owed to the Bank should have been repaid, plus any administrative charges.

2.4. No event of any incapacity or disability will be set up or pleaded to avoid or create liability unless notice in writing had been given to the Bank prior to the signing of this agreement or accessing or signing up for any Bank product or service.

2.5. The Bank will act on the instructions received by making applicable accounting entries and or collecting, receipting or transmitting payment instructions, on the day such request is received. All requests should be received by the Bank before cut-off time.

2.6. Notwithstanding any implied obligation upon the Bank, the Bank may from time to time set security features which limit the size of transactions that may be effected through e-banking or may require confirmation of any transaction by telephone or any other channel of communication.

2.7. An instruction is deemed to be received only once the Bank acknowledges or confirms receipt via Short Message Service, USSD or any other e-banking DO NOT re-send any instruction before checking your Statements and contacting our call Centre.

2.8. The Bank shall not be obliged to verify any document or the destination account numbers, party names or the amounts involved in any instruction, or inquire into the ability, competence, or extent of authority of any person to issue any document or to use its e-banking system. All data, document or information transmitted to the Bank is assumed to be The Bank should immediately be advised of any errors or discrepancies by the customer.

2.9. Once requested to disable an access code or any operating system, the Bank may reject all instructions received after such notification, suspend the processing of all instructions not yet executed, reverse (if possible) all executed transactions with effect from such date and time as may reasonably apply to the unauthorized use, and deactivate the access code access code.

2.10. Passwords/pin codes issued by the Bank shall be kept a secret by the Customer. All activities/ instructions executed shall be assumed to come from the Customer and are authority to act on such instruction and/ or message received.

2.11. Apart from dfcu applications on mobile application online stores, any other software downloaded from the Internet, whether from the Bank’s website or not, is third party software, the licensing of which shall be subject to such terms and conditions as the licensor may It is understood that the use of such software shall be at user’s risk and the Bank is held harmless against any loss or damage which may be suffered as a result of the use of such software.

2.12. At the request of the Customer, the Bank may issue cheque books to the Customer in accordance with any terms and conditions applicable to cheques. The Customer understands that;

a) The Bank may charge a fee for processing of cheque books for the Customer and that it shall be the duty of the Customer to observe that the account details and the details on the cheque book tally;

b) The Bank may refuse to honour any cheque not drawn properly or that has unauthorised erasures or alterations or which the Bank believes not to be sanctioned by the Customer;

c) All cheques or payment instruments accepted for deposit or collection with the Bank are at the risk of the Where any instrument is unpaid for any reason whatsoever, the Bank shall debit the Customer with the amount previously credited plus interest thereon if the account is thereby overdrawn.

d) The Bank is not liable for any loss or damage suffered if a dishonoured instrument is not noted or protested or both.

e) The Bank and the Customer agree that this right of set off may be exercised against any related parties.

3.0 LIMITATION OF LIABILITY

3.1 The Bank is excused from failing or delaying to act and no liability to the Bank arises if such failure or delay is caused by failure, malfunction or unavailability of telecommunications network, data communications and computer systems and services supplied and managed by third parties, fire, war, riot, theft, flood, earthquakes or other natural disaster, hostilities, invasion, civil unrest, strikes, industrial action or trade disputes.

3.2 The Bank is not liable for any claims or damages whatsoever relating to use of the communication system core-banking, including information contained on the communication system or inability to use the communication system or mobile phone or device and in particular the Bank is not liable for:-

a) Loss suffered as a result of forgery of signing mandates or signatures by third parties, compromise, theft or illegal and or unauthorised use of access codes, interruption, malfunction, downtime or other failure of the communication system or mobile telephone network, banking system, third party system, databases or any component part thereof for whatever reason;

b) Loss or damage which arises from orders, investment decisions, purchases or disposal of goods and services, including financial instruments or currencies, from third parties based upon the use of e-banking or information provided on the communication

c) Any event over which the Bank has no

d) Losses occasioned by forgery of the mandate or theft perpetrated by an employee or agent of the

e) No claim or demand for loss or compensation shall be brought against the Bank after the expiry of six (6) years from the date the customer shall be deemed to have been aware of the loss or damage.

3.3 In any event whether arising out of negligence or not, the liability of the Bank to the customer shall be the actual funds in the Bank lost by the Customer, if the customer shall not be found to have contributed to the loss.

3.4 dfcu Bank hereby notifies the customers that the default daily transaction limit for the Quick Banking and Online Banking platform can be customized to mitigate fraud on their Should the customer not indicate the preferred Quick Banking limit the Bank’s default limits will apply.

a) In the event of a lost and/or stolen phone, Customers are advised to make a report immediately to the Bank, through the toll free Call Centre number (0800 222 000 or email – customercare@dfcugroup.com) or visit the nearest dfcu Branch to prevent The Bank shall not be held liable for any loss in the event the said report is not made within a duration of 6 (six) hours from the time of loss/theft of phone.

b) dfcu Bank will not be held liable in the event a customer elects to save their PIN or password or confidential access details on their phone. This includes using a third-party password application manager or any similar automated password managing application on the said phone.

4.0 RIGHT OF SET OFF

4.1 The Bank may reverse, debit and or recover from the Customer funds credited or disbursed on account of the Such credits or disbursements shall be a liability to the customer and the Bank may without notice to the customer set off or recover from any account of the customer whether current, savings or any other account in the first instance to settle this liability.

4.2 The Bank shall by this clause maintain a general lien over the customer’s property/assets deposited with the Bank and may exercise the right of set off by realising such property.

4.3 The Bank shall after making a demand in writing to a Customer on whose account the money was paid in error to repay the money charge an interest against such a customer at the rate of 10% above the Bank’s prime lending rate, till all the money paid in error shall have been recovered.

5.0 FEES AND CHARGES

5.1 The Bank shall levy fees, charges or penalties from time to time for the use, misuse, default upon, repair or restoration of its services or incur any expense necessary to carry out any KYC or comply with any regulatory or legal.

5.2 The Bank shall be indemnified or defray from any funds available on any account of the Customer the costs of litigation, legal demands or any loss that the Bank may suffer in the process of effecting instructions of the Customer.

6.0 DISPUTE SETTLEMENT

6.1 In case of a dispute as to the effective time and date of notification that the passwords and or/ any equipment may have fallen in the hands of an unauthorized person, the time and date of the written notification to the Bank shall be

6.2 The Bank shall only carryout instructions which in its discretion are valid, legal or unambiguous. In the event of any doubt, dispute, suspicion of a commission of a criminal offence or challenge arising as to the right or capacity to operate the account, the Bank shall suspend the operation of the account till the dispute, challenge, doubt, or any proceedings are resolved.

6.3 All disputes relating to the operation of the accounts or arising out of this Agreement shall be amicably resolved by informal negotiations.

6.4 If after 14(fourteen) days from the commencement of such informal negotiations both Parties have been unable to resolve the dispute amicably, the matter shall be referred for Arbitration.

6.5 The Arbitration shall be presided over by a single Arbitrator appointed mutually by the Parties and where such mutual consent fails, by the President of Uganda Law Society.

6.6 Arbitration shall be concluded within sixty (60) days from the date of appointment of the Arbitrator and the arbitral award shall be final and binding on both Parties to the Agreement.

6.7 The Arbitration shall be conducted in Kampala, Uganda and the language of the arbitration proceedings shall be English.

6.8 This clause shall not preclude either Party from obtaining interim relief on an urgent basis from a court of competent jurisdiction pending the outcome of arbitration.

6.9 Each Party shall pay its own costs of and incidental to the arbitration proceedings including, professional fees.

7.0 DEALINGS WITH THE BANK

7.1 The Customer may upon notice in writing to the Bank appoint Agents/ Attorneys to effect transactions on the Customer’s account subject to such terms and conditions as may be permitted by the Bank.

7.2 The above provision notwithstanding, instructions should only be given in person by the customer and the Bank reserves the right to disregard and or refuse to honour any other instructions, including those given by duly appointed agents.

7.3 The Customer undertakes to make a full and true disclosure of their identity and address to the Bank, and the address given to the Bank upon the signing of this Agreement and unless a notice of change of address has been given to the Bank, such address shall be regarded as the true address of the Customer.

7.4 This Agreement constitutes a personal guarantee of the Directors/ Shareholders signing hereof in the event that the Customer is a juridical person. Read and Approved (in the applicant’s own handwriting) Customer/ Authorized signature or; (these terms and conditions have been read over and interpreted to me/us by

8.0 CONSENT TO DISCLOSURE OF PERSONAL INFORMATION

8.1 Consent to use of data held in the National Identification Register

You hereby consent to dfcu Bank accessing and using your personal information contained in the National Identification Register maintained by the National Identification and Registration Authority (NIRA). This consent does not waive your right to seek independent legal advice or to take legal action if your privacy rights are violated.

8.2 Credit Reference Bureau Consent

By submitting an application for credit facilities, you agree to be bound by the following requirements relating to the collection and submission of information to and from the Credit Reference Bureau and the issue of a financial card whether or not the application for credit facilities is approved;

8.3 “Credit Reference Bureau Business” means the business of disseminating credit information among Financial Institutions, Microfinance Deposit-Taking Institutions and such other Accredited Credit Providers as shall be approved by the Central Bank for their businesses.

8.4 “Credit Information” means all data and details relating to an individual or organisation’s credit history, financial status, or debt repayment behaviour, including but not limited to; payment history, outstanding financial obligations, credit accounts, and any public records (including bankruptcies) which allows dfcu Bank to determine the financial situation and exposure of the concerned person. And, any other information collected, pursuant to the legal provisions in force, from any public or private sources of information with no restricted access, including but not limited to credit or financial

8.5 Consent to disclosure of confidential information

You hereby

a) further irrevocably consent to dfcu Bank collecting, compiling, receiving, sharing and retaining Credit information about you for the purposes of

i) assisting the Bank to perform its statutory assessment of your creditworthiness deciding whether or not to grant you credit; and monitoring your credit profile should we grant you credit; and

ii) deciding whether or not to extend credit facilities to you

iii) monitoring your credit profile, should we opt to extend credit facilities to you

iv) filing our Customer Credit Information with the Credit Reference

b) consent to dfcu Bank debiting your account to a tune of UGX 20,000/= or such other sums as it may from time to time advise, which money shall be used to run credit checks with the credit reference

c) consent to the receipt, sharing, provision and exchange of data with Credit Reference Bureaus and with other licensed financial institutions and micro finance deposit taking institutions through the Credit Reference Bureau, provided that you reserve the right to lodge a complaint with the Credit Reference Bureau or to challenge any Customer Credit Information held by the Credit Reference Bureau in your respect;

d) acknowledge that the Customer Credit Information obtained may include positive or negative information regarding your credit worthiness;

e) acknowledge that the Credit Reference Bureau is required by law to collect adverse information on the background and credit history relating to your nonperforming obligations;

f) we may provide to the Credit Reference Bureau your personal information including fingerprints, photographs as well as name and contact details amongst other identifying information;

g) the information on the financial card may be used to link credit profiles and financial information to you, which information will be housed on the database files of the Credit Reference Bureau; and your Financial card may be used to verify your identity at a Branch or at any other institution with a compatible card reading device.

8.6 “Adverse Information” means any negative information, data, or record indicating a borrower’s unsatisfactory credit history, financial instability or debt repayment issues, including but not limited to; credit default on all types of facilities, bounced cheques, frauds or forgeries, tendering false securities, debt collections, charge offs, false declarations and statements, receiverships, bankruptcies and liquidations, accounts compulsory closed other than for administrative

8.7 “Positive Information” means favourable data, record, or information, demonstrating a borrower’s satisfactory credit history and financial obligations including but not limited to; timely payments, low debt to income ratios, long standing credit accounts in good standing, successful debt repayment history, absence of adverse credit

8.8 In terms of default as stated in the Facility Letter/Letter of Offer/ facility terms and conditions, attached hereto, you agree that your name, and the full transaction details of the negative information may be passed by dfcu bank to the Credit Reference Bureaus for circulation to other credit grantors who may use such information to assess your credit worthiness for their own business purposes after a written notice of 28 (twenty eight days) from the date of default.

9.0 SANCTIONS CLAUSE

9.1 It is understood that the Bank will undertake sanction screening of the customer and its related By submitting information pertaining to the customer and related parties, the customer authorizes the Bank to undertake sanction screening, and where applicable confirms having procured necessary consent for the Bank to undertake sanction screening on the related parties.

9.2 You undertake to immediately notify the Bank upon becoming the subject of sanctions investigations where upon the Bank maintains the right to terminate the relationship should I/We become the subject of Sanctions under a regulatory body duly authorised to issue such sanctions including; the government of Uganda, His Majesty’s Treasury of the United Kingdom (HMT), the Office of the Foreign Assets Control of the Department of Treasury of the United States of America (“OFAC”), the United Nations Security Council (“UNSC”), the European Union’s Common Foreign and Security Policy (EU) and the French Ministry of Economic, Finance and Industry.

10.0 INDEMNITY CLAUSE

10.1 You hereby indemnify the bank against any actions, proceedings, claims and/or demands that may be brought against the Bank, as well as against losses, damages, costs and expenses which I/we may incur in connection with the seizure, blocking, withholding of any funds by any competent authority and any activity which directly or indirectly benefits any party against who sanctions have been established by any competent authority.

10.2 You undertake that; I/we will not use (or otherwise make available) the funds/ facilities on this account(s) for the purposes of financing, directly or indirectly, the activities of any person which is Sanctioned or in a country which is subject to any Sanctions; I/We will not contribute or otherwise make available, directly or indirectly, the funds/ facilities on this account (s) to any other person or entity if such party uses or intends to use such funds/ facilities for the purpose of financing the activities of any person or entity which is subject to any Sanctions; I/we am not/aren’t involved in any illegal or terrorist activities currently or in the foreseeable future the subject of any sanctions investigation and shall notify the Bank if my/our customer/parent/ shareholder/surety and/or grantor becomes the subject of a sanctions investigation.

Share my/our personal information within the Bank for marketing purposes and that the Bank may then market its products, services and special offers to me.

Communicate other third-party products, services and special offers to me. If I/We respond positively to the communication, they may contact me. Contact me for research purposes. (The research companies will follow strict codes of conduct and treat customer information confidentially

11. CONFIDENTIALTY CLAUSE

11.1 This Agreement imposes confidentiality obligations upon the These obligations shall not apply in the event of suspicion of commission of a criminal act, default upon any obligation to the Bank, sharing of customer’s profile with the Credit Reference Bureau, under a Court Order or Regulatory Authority or with any person entitled by virtue of any legislation.

12. TERMINATION CLAUSE

12.1 This Agreement may be terminated at any time by the Customer upon giving notice of 14 days and settling any obligations to the The Bank may however immediately terminate the Agreement if the Customer is suspected to have misrepresented any fact, committed any financial crime, or where it would be risky in the discretion of the Bank to deal with such a Customer.

13. INACTIVE, OVERDRAWN AND DORMANT ACCOUNT;

a) The above provision notwithstanding, the Bank may close an account if the same is overdrawn for six months.

b). The Bank may internally classify a current Account as inactive if there are no customer-induced transactions for 12 months in the Account.

c) The Bank will classify any account as Dormant if there are no customer-induced transactions for 24 months in the Therefore, in both (b) and (c), the customer will be required to reactive it prior to resuming transacting thereon.

14 The Bank may with or without notice to the Customer assign all rights and obligations arising out of this Agreement to any person at any time. The Customer shall however seek the consent of the Bank in writing before making any assignment of its rights or obligations under this Agreement.

15. SEVERABILITY

If any part, term or provision of this Agreement not being of a fundamental nature should be held illegal or unenforceable, the validity or enforceability of the remainder of this Agreement shall not be affected

16. ANTI BRIBERY & ANTI CORRUPTION

16.1 The Customer shall comply with all applicable laws, statutes, regulations, policies and procedures relating to and governing anti-bribery and anti-corruption including but not limited to the Anti-Corruption Act 2009, and the Bank’s related policies and procedures.

The customer shall not engage in any activity, practice or conduct which would constitute an offence under the Act or policies. The Parties shall not and shall procure that their employees, agents and sub-contractors not to offer, solicit or accept an inducement/advantage in connection with the service under the contract.

16.2 Breach of this clause shall be deemed a material breach of these Standard Terms and Conditions and the Bank shall be entitled to terminate the Banking relationship with the Customer immediately.

-

QuickBanking Terms and Conditions

- DEFINITIONS

“Account’ means a bank account in Uganda Shillings or in foreign currency maintained by the Customer with the Bank.

“Agent” means any person authorised by the Customer or Authorised signatory to receive and collect payments or effect transactions in any form acceptable by the Bank;

“Bank” means dfcu Bank Limited;

“Business day” means any day on which the Bank is open for business in Uganda;

“Customer” shall mean a person who using the Bank services and includes natural and juridical persons, associations or community-based organisations.

‘‘Cut-off time” means the time after which transactions will be accounted for on the next business day.

“E-banking” means and includes; electronic banking, Interactive Voice Response, Quick banking, mobile banking, telephone and any other electronic banking service offered by the Bank.

“E-banking services” means the electronic banking services or Services offered by the Bank that allow access and transactions on the Customer Account using internet banking, mobile banking, Unstructured Supplementary Service data (USSD), computer applications or any other electronic channels.

“Instrument” means any payment instrument and includes but is not limited to cheques, standing orders, RTGS, EFTs or any other financial instrument.

“Mandate” shall mean the extent of authority of the Customer or its agents to operate an account;

“Related Parties” means and includes Customer(s) who operate separate accounts but have a common financial interest, ownership, directorship, or shareholding or any other common interest.

“Service/s” means and includes any service offered by the Bank.

“Special Terms and Conditions” means the terms and conditions that may be published by the Bank from time to time in relation to a specific product and / or service on offer by the Bank.

“System” means and includes any electronic, digital, signal, computer or computer programme, telephone or any other device or gadget used to access e –banking.

“System Identity” means any number, sign, password, or code used to access e-banking.

“User” shall mean a person who is using the Bank’s E-banking platforms or any software and includes natural and juridical persons, associations, or community-based organisations.

2.0 AGREEMENT

2.1. These Terms and Conditions apply to all services offered by the Bank and apply immediately upon, signing up, registration or once the Services are accessed. By signing this Agreement and signing up for any Service or product on offer, the Customer is deemed to have notice of all the special terms and conditions that apply to the respective product or Service.

2.2. Any Service offered by the Bank may be modified, replaced or withdrawn at any time upon issuance of the requisite thirty (30) days’ notice to the Customer through the media or Customer’s last known address or through appropriate display, in which event the Bank shall incur no liability whatsoever.

2.3 There is a cooling off period of ten (10) working days from the date of application or signing up for the Bank Services within which period, the Customer may revoke or terminate this Agreement. This right is exercisable at any time within the above mentioned ten (10) working days by which period any money owed to the Bank should have been repaid, plus any administrative charges.

2.4 No event of any incapacity or disability will be set up or pleaded to avoid or create liability, unless notice in writing had been given to the Bank prior to the signing of this Agreement or accessing or signing up for any Bank product or Service.

2.5 The Bank will act on the instructions received by making applicable accounting entries and /or collecting, receipting or transmitting payment instructions, on the day such request is received. All requests should be received by the Bank before cut-off time.

2.6 Notwithstanding any implied obligation upon the Bank, the Bank may from time to time set security features, which limit the size of transactions that may be effected through E-banking or may require confirmation of any transaction by telephone or any other channel of communication.

2.7 An instruction is deemed to be received only once the Bank acknowledges or confirms receipt via Short Message Service, USSD or any other E-banking platform. DO NOT re-send any instruction before checking your statements and/or contacting our call centre.

2.8 The Bank shall not be obliged to verify any document or the destination account numbers, party names or the amounts involved in any instruction, or inquire into the ability, competence, or extent of authority of any person to issue any document or to use its e-banking system. All data, document or information transmitted to the Bank is assumed to be correct. The Bank should immediately be advised of any errors or discrepancies by the Customer.

2.9 Once requested to disable an access code or any operating system, the Bank may reject all instructions received after such notification, suspend the processing of all instructions not yet executed, reverse (if possible) all executed transactions with effect from such date and time as may reasonably apply to the unauthorized use, and deactivate the access code.

2.10 Passwords/PIN codes issued by the Bank shall be kept a secret by the Customer. All activities/instructions executed shall be assumed to come from the Customer and the Bank shall have authority to act on such instruction and/ or message received.

2.11 Apart from the Bank applications on mobile application online stores, any other software downloaded from the internet, whether from the Bank’s website or not, is third party software, the licensing of which shall be subject to such terms and conditions as the licensor may impose. It is understood that the use of such software shall be at user’s risk and the Bank is held harmless against any loss or damage which may be suffered as a result of the use of such software.

2.12 This Agreement imposes confidentiality obligations upon the Bank. These obligations shall not apply in the event of suspicion of commission of a criminal act, default upon any obligation to the Bank, sharing of Customer’s profile with the Credit Reference Bureau, under a Court Order or Regulatory Authority or with any person entitled by virtue of any legislation.

2.13 This Agreement may be terminated at any time by the Customer upon giving notice of 14 days and settling any obligations to the Bank. The Bank may however immediately terminate the Agreement if the Customer is suspected to have misrepresented any fact, committed any financial crime, or where it would be risky in the discretion of the Bank to deal with such a Customer.

2.14 Inactive, Overdrawn and dormant accounts;

a). The above provision notwithstanding, the Bank may close an account if the same remains overdrawn for sixty (60) days.

b). The Bank may internally classify a Current Account as an inactive if there are no Customer-induced transactions for 12 months in the Account.

c). The Bank will classify any account as Dormant if there are no customer-induced transactions for 24 months in the account. Therefore, in both 2.14 (b) and 2.14 (c), the Customer will be required to reactivate an account prior to resuming transaction thereon.

2.15 The Bank may with or without notice to the Customer assign all rights and obligations arising out of this Agreement to any person at any time. The Customer shall however seek the consent of the Bank in writing before making any assignment of his/her rights or obligations under this Agreement.

3.0 LIMITATION OF LIABILITY

3.1 The Bank is excused from failing or delaying to act and no liability to the Bank arises if such failure or delay is caused by failure, malfunction or unavailability of telecommunications network, data communications and computer systems and services supplied and managed by third parties, fire, war, riot, theft, floods, earthquakes or other natural disaster, hostilities, invasion, civil unrest, strikes, industrial action or trade disputes.

3.2 The Bank is not liable for any claims or damages whatsoever relating to use of the communication system or E-banking, including information contained on the communication system or inability to use the communication system or mobile phone or device and in particular the Bank is not liable for:-

- a) Loss suffered as a result of forgery of signing mandates or signatures by third parties, compromise, theft or illegal and or unauthorised use of access codes, interruption, malfunction, downtime or other failure of the communication system or mobile telephone network, banking system, third party system, databases or any component part thereof for whatever reason;

- b) Loss or damage which arises from orders, investment decisions, purchases or disposal of goods and services, including financial instruments or currencies, from third parties based upon the use of E-banking or information provided on the communication system.

- c) Any event over which the Bank has no control.

- d) Losses occasioned by forgery of the mandate or theft perpetrated by an employee or agent of the Customer.

- e) No claim or demand for loss or compensation shall be brought against the Bank after the expiry of six (6) years from the date the Customer shall be deemed to have been aware of the loss or damage.

3.3 In any event whether arising out of negligence or not, the liability of the Bank to the Customer shall be the actual funds in the Bank lost by the Customer, if the Customer shall not be found to have contributed to the loss.

4.0 AVAILABILITY OF SERVICE

4.1 The Bank undertakes to endeavour to have the service available on the days and between the hours advised by the Bank to the Customer from time to time. The Customer therefore acknowledges and accepts that the E-banking services may be unavailable from time to time for any reason, including but not limited to technical failure, other supervening factors or problems with any communication system directly or indirectly underlying the E-banking service, whether owned or controlled by the Bank or a third party; technical failure or unavailability of a bank system; unavailability of the telecommunication or electricity services; or other circumstances beyond our control. The Customer undertakes, in the event of unavailability of the E-banking services to utilise alternative channels to access the Bank’s Services for the duration of the unavailability of electronic banking.

4.2 The operation hours may be varied or suspended by the Bank, although in all such cases the Bank will endeavour to notify and advise the Customer in advance through the available communication channels.

4.3 This Service may be modified, replaced or withdrawn upon issuance of the requisite 30 days’ notice to the Customer through media or last known address of the Customer, in which event, the Bank shall incur no liability whatsoever.

5.0 RIGHT OF SET OFF

5.1 The Bank may reverse, debit and/or recover from the Customer funds wrongly credited or disbursed on account of the Customer. Such credits or disbursements shall be a liability to the Customer and Bank may without notice to the Customer set off or recover from any account of the Customer whether current, savings or any other account in the first instance to settle the liability.

5.2 The Bank shall by this clause maintain a general lien over the Customer’s property/assets deposited with the Bank and may exercise the right of set off by realising such property.

5.3 The Bank shall make a demand in writing to a Customer on whose account money was paid in error to repay the money. Should the Customer not pay back the money within … (include a timeline), the Bank shall be entitled to charge interest against such a Customer at the Bank’s Prime Lending rate, until all the money paid in error shall have been recovered.

5.4 The Bank and the Customer agree that this right of set off may be exercised against any related parties.

6.0 FEES AND CHARGES

6.1 The Bank shall levy fees, charges or penalties from time to time for the use, misuse, default upon, repair or restoration of its services or incur any expense necessary to carry out any Know Your Customer or comply with any regulatory or legal requirements. The fees shall be as per the Bank’s tariff guide.

6.2 The Bank shall be indemnified or defrayed from any funds available on any account of the Customer, the costs of litigation, legal demands or any loss that the Bank may suffer in the process of effecting instructions of the Customer.

7. COMPLIANCE WITH LAWS

The Customer undertakes to comply with all statutory and regulatory requirements in Uganda, from time to time in force, governing their respective business operations.

8.0 ANTI BRIBERY AND ANTI CORRUPTION

8.1 The Customer shall comply with all applicable laws, statutes, regulations, policies and procedures relating to and governing anti-bribery and anti-corruption including but not limited to the Anti-Corruption Act 2009, and the Bank’s related policies and procedures. The customer shall not engage in any activity, practice or conduct which would constitute an offence under the Act or policies. The Parties shall procure their employees, agents and sub-contractors not to offer, solicit or accept an inducement/advantage in connection with the service under the contract.

8.2 Breach of this clause shall be deemed a material breach of these Standard Terms and Conditions and the Bank shall be entitled to terminate the Banking relationship with the Customer immediately.

9 SANCTIONS

It is understood by the Customer that the Bank may undertake sanction screening of the Customer and/ or the Customer’s representatives. By submitting information pertaining to the Customer and/or the Customer’s representatives, the Customer authorizes the Bank to undertake sanction screening, and where applicable confirms having procured necessary consent for the Bank to undertake the sanction screening.

The Customer undertakes to immediately notify the Bank upon becoming the subject of sanctions investigations; the Bank maintains the right to terminate the relationship on becoming aware that the customer is the subject of Sanctions under a regulatory body duly authorized to issue such sanctions including: the government of Uganda, Her Majesty’s Treasury of the United Kingdom (HMT), the Office of the Foreign Assets Control of the Department of Treasury of the United States of America (“OFAC”), the United Nations Security Council (“UNSC”), the European Union’s Common Foreign and Security Policy (EU) and the French Ministry of Economic, Finance and Industry.

10 DATA PROTECTION

10.1 The Customer and the Bank will observe all applicable legal provisions on data protection and will collect, store and process personal data only if necessary, for the performance of this Agreement and to the extent legally permitted or where an express consent of the relevant affected person has been provided.

10.2 The Bank acting as a data controller, warrants that it complies with all applicable data protection and privacy laws in Uganda.

10.3 The Bank acting as data processor, warrants to limit the processing of personal data to the extent legally permitted by the laws in Uganda.

10.4 If the Customer submits Personal Information to the Bank on behalf of another person, then the Customer warrants that they have authorization of the data owner to process their Personal Information.

11.0 DISPUTE SETTLEMENT

11.1 In case of a dispute as to the effective time and date of notification that the passwords and or/ any equipment may have fallen in the hands of an unauthorised person, the time and date of the written notification to the Bank shall be the conclusive time and date of notification.

11.2 The Bank shall only carryout instructions which in its discretion are valid, legal or unambiguous. In the event of any doubt, dispute, suspicion of a commission of a criminal offence or challenge arising as to the right or capacity to operate the account, the Bank shall suspend the operation of the account until the dispute, challenge, doubt, or any proceedings are resolved.

11.3 All disputes relating to the operation of the accounts or arising out of this Agreement shall be amicably resolved and no suit shall be competent in any Court unless the Parties shall have failed to amicably resolve the dispute.

11.4 If, after 14(fourteen) days from the commencement of such informal negotiations both Parties have been unable to resolve the dispute amicably, the matter shall be referred for Arbitration in accordance with the International Centre for Arbitration & Mediation in Kampala (Mediation) Rules 2018 or its successor legislation.

11.5 The Arbitration shall be presided over by a single Arbitrator appointed mutually by the parties and where such mutual consent fails, by the Head of the International Centre for Arbitration & Mediation in Kampala (ICAMEK).

- Arbitration shall be concluded within sixty (60) days from the date of appointment of the Arbitrator and the arbitral award shall be final and binding on both Parties to the Agreement.

- The Arbitration shall be conducted in Kampala, Uganda and the language of the arbitration proceedings shall be English.

- This clause shall not preclude either Party from obtaining interim relief on an urgent basis from a court of competent jurisdiction pending the outcome of arbitration.

- Each Party shall pay its own costs of and incidental to the arbitration proceedings including, professional fees.

- DEALINGS WITH THE BANK

12.1 The Customer may upon notice in writing to the Bank appoint Agents/Attorneys to effect transactions on the Customer’s account subject to such terms and conditions as may be permitted by the Bank.

12.2 The above provision notwithstanding, instructions should only be given in person by the Customer and the Bank reserves the right to disregard and or refuse to honour any other instructions, including those given by duly appointed agents.

12.3 The Customer undertakes to make a full and true disclosure of their identity and address to the Bank, and the address given to the Bank upon the signing of this Agreement and unless a notice of change of address has been given to the Bank, such address shall be regarded as the true address of the Customer.

12.4 This Agreement constitutes a personal guarantee of the Directors/Shareholders signing hereof in the event that the Customer is a juridical person.

13 PERMISSION TO PROCESS PERSONAL INFORMATION

13.1 You consent to the Bank collecting your personal information submitted to it and where lawful and reasonable, collected from public sources, for credit related purposes, detection or investigation of fraud or other illegal activity, compliance with regulatory requirements, as well as the purposes set out in the subsequent sub-clauses.

13.2 You consent to us processing your personal information within the Bank and through third parties in and outside Uganda, to the extent necessary for us to provide you with our products and services, and to ask all parties that receive your personal Information to agree to our privacy policies.

13.3 If you give us personal information about or on behalf of another person, you undertake and hereby confirm that you would have obtained authorisation of the data subject for the Bank to collect and process their personal information in and outside the country where the products or services are provided.

13.4 As part of our services, we would like to give you information about products and services offered by the Bank. As your personal information is confidential, we need your consent to share it for the purposes below;

I give my consent to the Bank’s

- sharing my personal information within the Bank for marketing purposes and that the Bank may then market its products, services and special offers to me.

- communicating third-party products, services and special offers to me. If I respond positively to the communication, the Bank may contact me.

- for research purposes. (The research companies will follow strict codes of conduct and treat customer information confidentially).

14 INDEMNITY

The Customer hereby agrees to indemnify the Bank against any actions, proceedings, claims and/or demands that may be brought against the Bank, as well as against losses, damages, costs and expenses which the Customer may incur in connection with the seizure, blocking, withholding of any funds by any competent authority and any activity which directly or indirectly benefits any party against who sanctions have been established by any competent authority.

14.1 The Customer undertakes that; he/shewill not use (or otherwise make available) the funds/facilities on this account (s) for the purposes of financing, directly or indirectly, the activities of any person which is sanctioned or in a country which is subject to any sanctions; he/she will not contribute or otherwise make available, directly or indirectly, the funds/ facilities on this account (s) to any other person or entity if such party uses or intends to use such funds/ facilities for the purpose of financing the activities of any person or entity, which is subject to any sanctions; he/she are not involved in any illegal or terrorist activities currently or in the foreseeable future the subject of any sanctions investigation and shall notify the Bank if your customer/parent/ shareholder/ surety and/or grantor becomes the subject of a sanctions investigation.

15 SEVERABILITY

If any part, term or provision of this Agreement not being of a fundamental nature should be held illegal or unenforceable, the validity or enforceability of the remainder of this Agreement shall not be affected.

16 GOVERNING LAW

This Agreement shall be governed, interpreted and construed in accordance with the Laws of the Republic of Uganda. The Parties furthermore undertake to comply with all statutory and regulatory requirements in Uganda, from time to time in force.

Read and Approved by the Customer Digitally (these terms and conditions have been read over and interpreted to/by me, and I confirm that I fully appreciate the nature of the agreement and agree to be bound by all the terms and conditions.

-

Mobi Loan Terms & Conditions

1. INTRODUCTION AND APPLICATION OF THE TERMS

1.1 These Terms and Conditions (“Terms”) become effective when you apply for, or access the dfcu MobiLoan (hereinafter referred to as “MobiLoan” or “Facility”).You may only use the Facility in accordance with these Terms.

1.2 You must read, understand and comply with these Terms, as they form a binding agreement between you and dfcu bank (“the Bank”).

1.3 It is important to read and understand the Terms and Conditions each time before you apply for the MobiLoan.

1.4 Note that the Bank may update these Terms from time to time, the most up to date version of the Terms and Conditions will be available to you each time you apply for the MobiLoan.

2. APPLICATION FOR A FACILITY AND ACCEPTANCE OF A MOBILOAN FACILITY

2.1 Any MobiLoan applied for using your account credentials shall be deemed to have been initiated and authorised by you.

2.2 When you authorise a Facility or when deemed to have authorized a Facility, you will be assumed to have given authorization to the Bank to book the Facility and credit your account with the amount of the Facility for which you qualify.

2.3 You agree to electronically accept the Facility and applicable Terms and Conditions. You, the borrower, will be bound by your acceptance of the Facility.

3. CONDITIONS PRECEDENT TO FACILITY UTILISATION

Without prejudice to the discretion of the Bank to grant the MobiLoan, the availability of the Facility will be subject to the following conditions:

a) due diligence and vetting of the Borrower by the Bank;

b) the Borrower qualifying for the MobiLoan under the criteria set by the Bank and the Bank approving the MobiLoan;

c) all fees and interest, other than default interest, being paid upfront by the Borrower from the Facility amount;

d) no event of default has occurred and is continuing and/or would result from the advance, drawdown or availment of the Facility;

e) each of the representations and warranties being true and correct as of the date of drawdown before and after the drawdown(s);

f) the absence of any Material Adverse Change which would affect the ability of the Borrower to perform its obligations under this agreement.

4. REPRESENTATIONS AND WARRANTIES

The Borrower represents and warrants to the Bank that the execution of the Terms and Conditions or any other document that the Borrower may be required to execute in relation to the Facility and the performance of the terms arising thereunder are within the Borrower’s powers and or have been duly authorised by all necessary actions and do not and will not contravene any law or any contractual or other restriction binding upon you.

5. THE BORROWER COVENANTS WITH THE BANK THAT:

5.1 If the Borrower shall default in payment of the Facility the whole sum outstanding together with default interest thereon shall become immediately due and payable.

5.2. Any amount not repaid by its due date shall after the due date thereof attract the default interest as stated in clause 6.2.

6. PRICING

6.1 Interest

Interest shall be charged at the rate of 10.8% for personal MobiLoan and 12% for SME MobiLoan per month; interest will be paid upfront at disbursement from the Facility amount.6.2 Interest on Overdue amounts

Any amount not repaid by its due date shall after the due date thereof attract a default interest at a rate of 1% per day for the first fifteen (15) days following default.6.3 Changes in Interest Rate

The Bank reserves the right to change the interest rate and the method of calculating interest at any time, in line with market conditions and or the risk rating of the Facility. The changes in interest rate may be notified to you via our website or may be published by the Bank in any national newspaper.6.4 Tariff Guide

The services offered by the Bank are subject to the fees stated in the Bank’s Tariff guide that may be accessed at any of the Bank’s premises or the Bank’s website. The fees and rates applicable to the Facility may similarly be varied and notified to you via our website, published in the Bank’s Tariff Guide that may be accessed at any of the Bank’s branches or a notice published in a newspaper of wide circulation.

7. APPLICATION OF MONEY RECEIVED TO REPAY THE FACILITY

If any sum paid or recovered in respect of the Borrower’s liability is less than the amount then owing, the Bank may apply that sum to interest, fees, principal or any amount due in such proportions and order or in such manner as the Bank thinks fit.

8. COST, EXPENSES AND FEES

8.1 The Borrower agrees that all costs and expenses whatsoever including legal and auctioneers costs connected with the recovery or attempted recovery of money owing under the Facility as well as the contesting of any involvement in any legal proceedings of whatsoever nature by the Bank in connection with any account(s) of the Borrower shall be payable by the Borrower on demand, on a full indemnity basis, together with interest from the date the costs and expenses are incurred to the date of full payment at such rate as the Bank may prescribe (both before and after judgement).

8.2 The Bank shall have the right at any time to debit the Borrower’s account with interest, commission, charges, fees, and all monies arising from the Facility as well as all amounts and sums of money mentioned in the preceding subparagraph as being payable by the Borrower. No such debiting shall be deemed to be a payment of the amount due (except to the extent of any amount in credit in the Borrower’s account(s) or a waiver of any event of default under any agreement relating to the facilities. If such debiting causes the Borrower account to be overdrawn or overdrawn beyond the permitted limit, interest and any other applicable charges shall be payable accordingly.

8.3 The Bank reserves the right to review, amend, alter fees and commission at its sole discretion as appropriate and advise the Borrower accordingly.

9. PAYMENTS

9.1 All payments by the Borrower in respect of the Facility shall be made in full without set-off deductions of counterclaims. Such payments shall be free of and without deduction for or on account of tax unless the Borrower is required by law in any jurisdiction to make any such payments subject to such withholdings or deductions. In which case the Borrower shall pay such additional amount to the Bank as may be necessary in order that the actual amount received after such withholding or deduction shall be equal to the amount that would have been received if such withholding or deduction were not required. The Borrower shall fully indemnify the Bank from any liability with respect to the delay or failure by the Borrower to pay any taxes or charges. Without prejudice to the foregoing, the Borrower shall complete such forms and documentation as may be required from time to time by the Bank for the purpose of conferring upon the Bank the benefit of any applicable tax treaties or provision under applicable law for any other purposes in connection therein.

9.2 In the event that the loan falls into arrears and remains unpaid beyond the agreed repayment date, the Bank reserves the right to recover the outstanding amount by offsetting funds available in any other personal accounts held by the customer with the Bank.

10. WAIVER NOT TO PREJUDICE BANK’S RIGHTS

The Bank may as it deems fit refrain from or forbear to enforce any of the terms in this Agreement or waive such conditions of any breach of the Borrower or the same without prejudice to its right at any time afterwards to act strictly in accordance with the originally agreed terms in respect of the existing or subsequent breach.

11. AVAILABILITY

The availability of this Facility is at all times subject to the compliance in such manner as the Bank thinks fit with any and all restrictions of the Central Bank of Uganda or any other applicable regulatory authority from time to time in force and all terms and conditions thereof remain subject to any directions of the Central Bank of Uganda as advised to the Bank from time to time.

12. PAYMENT ON DEMAND

In terms of normal Banking practice, the Facility or part thereof may be recalled by the Bank by written notice to that effect, payable either upon demand or within a period stated in the notice in which event the Facilities in question are cancelled and any liability to the Bank becomes payable either forthwith or on the date stated in the demand, as the case may be.

13. CURRENCY CONVERSION

The Bank reserves the right to convert any amount held and due to the Borrower for purposes of obtaining an amount equivalent to the Borrower’s obligation under the Facility. The Bank’s applicable exchange rate for the day shall apply to the conversion. The shortfall and exchange risk associated with the conversion shall be borne by the Borrower.

14. BANK’S RIGHT TO WITHDRAW MOBILOAN PRODUCT

14.1 The Bank reserves the right to withdraw the MobiLoan offering without prior notice to the Borrower.

14.2 The Facility will expire and terminate and will be payable upon expiry of the tenure. Typically, the tenure for the MobiLoan is not more than thirty (30) days. Notwithstanding the expiry of the Facility, these Terms and Conditions once accepted shall remain in full force and effect, until the Facility and applicable interest is repaid.

15. DISBURSEMENT

Notwithstanding any provision or any Agreement between the Bank and the Borrower, the Bank shall not be obliged to make any disbursement in the following circumstances;

a) during the existence of a default or an event of default;

b) Unless and until the conditions precedent to every disbursement have been fulfilled by the Borrower;

c) If the disbursement would cause the limit of the Facility to be exceeded.

16. DISCLAIMERS AND WARRANTIES

16.1 The Bank is neither responsible for, nor liable to You, for any loss due to:

- interruption in the processing of the Facility or delay resulting from circumstances beyond its reasonable control. This includes power failure and network/technical faults, interruptions or delays in, communication with any telecommunication network, internet, Bank system or other system;

- any of your instructions not being sufficiently clear;

- any failure by you to provide correct information;

- any failure by you to keep your account details, mobile phone or any other credentials used to access your account with the Bank or a MobiLoan, in safe custody;

- any failure by you to report to the Bank immediately upon loss of your account credentials that may be used to fraudulently access your account with the Bank;

- any indirect, special or consequential losses;

16.2 The Bank shall rightly assume that all applications for, acceptance and utilisation of the MobiLoan using your mobile phone number or credentials are done and are authorized by you. The Bank shall not be held liable for transactions carried out on the contrary.

17. PERMISSION TO PROCESS PERSONAL INFORMATION

17.1 By applying for, accepting or using the MobiLoan, the Borrower consents to the Bank collecting his/her/its personal information submitted to the Bank and where lawful and reasonable, collected from public sources, for credit related purposes, detection or investigation of fraud or other illegal activity, compliance with regulatory requirements, as well as the purposes set out in the subsequent sub-clauses.

17.2 You further consent to the Bank’s processing your personal information within the Bank and through third parties in and outside Uganda, to the extent necessary for us to provide you with our products and services, and to ask all parties that receive your personal Information to agree to our privacy policies.

17.3 If you give us personal information about or on behalf of another person, you undertake and hereby confirm that you would have obtained authorisation of the data subject for the Bank to collect and process their personal information in and outside the country where the products or services are provided.

17.4 As part of our services we would like to give you information about products and services offered by the Bank. As your personal information is confidential, we need your consent to share it for the purposes below, you consent will be deemed to have been given when you accept the MobiLoan terms and conditions. In event you are not agreeable to us sharing your personal information, please contact any of our branches and lodge your written objection for our further action. Consent given includes:

- sharing your personal information within the Bank for marketing purposes, the Bank may market its products, services and special offers to you;

- communicating third-party products, services and special offers to you. If you respond positively to the communication, the Bank may contact you.

- contacting you for research purposes. (The research companies will follow strict codes of conduct and treat customer information confidentially.

18. SANCTION SCREENING

18.1 It is understood that the Bank will undertake sanction screening of the Borrower and their related parties. By submitting information pertaining to the Borrower and their related parties, the Borrower authorizes the Bank to undertake sanction screening, and where applicable confirms having procured necessary consent for the Bank to undertake sanction screening on the related parties.

18.2 The Borrower undertakes to immediately notify the Bank upon becoming the subject of sanctions investigations; the Bank maintains the right to terminate the relationship should the Borrower become the subject of Sanctions under a regulatory body duly authorised to issue such sanctions including; the government of Uganda, His Majesty’s Treasury of the United Kingdom (HMT), the Office of the Foreign Assets Control of the Department of Treasury of the United States of America (“OFAC”), the United Nations Security Council (“UNSC”), the European Union’s Common Foreign and Security Policy (EU) and the French Ministry of Economy, Finance and Industry.

18.3 You hereby indemnify the Bank against any actions, proceedings, claims and/or demands that may be brought against the Bank, as well as against losses, damages, costs and expenses which you may incur in connection with the seizure, blocking, withholding of any funds by any competent authority and any activity which directly or indirectly benefits any party against who sanctions have been established by any competent authority.

18.4 You undertake that; You will not use (or otherwise make available) the funds/facilities on this account (s) for the purposes of financing, directly or indirectly, the activities of any person which is Sanctioned or in a country which is subject to any Sanctions; You will not contribute or otherwise make available, directly or indirectly, the funds/ facilities on this account (s) to any other person or entity if such party uses or intends to use such funds/ facilities for the purpose of financing the activities of any person or entity which is subject to any Sanctions; You are not involved in any illegal or terrorist activities currently or in the foreseeable future the subject of any sanctions investigation and shall notify the Bank if You become the subject of a sanctions investigation

19. CREDIT INFORMATION SHARING

The Borrower expressly permits and authorises the Bank at its sole discretion to carry out credit checks on the Borrower or disclose the Borrower’s credit information to any authorised Credit Reference Bureau or member Financial Institutions, the Bank’s holding company and or associate/ subsidiaries, Government Agencies, External Auditors, Bank Lawyers, Bank Auctioneers, Bank Insurers and any other legal authorities. Such information may be used by other Banks or institutions for among others, assessing credit applications, debt tracing and fraud prevention as may be required by law or regulations. In this respect, the Borrower shall hold the Bank, all its officers, employees and agents indemnified from any action, proceedings or liability whatsoever relating to such disclosure.

20. ASSIGNMENT

The Bank may assign or transfer all or any part of its rights and benefits and obligations under this Agreement to any other person. Any such assignee or transferee shall have the same rights against the Borrower as if it had been a party to this Agreement as the Lender (to the extent of the rights assigned or transferred). It will not be necessary for the Borrower to take any action and or execute any documents to give effect to any such assignment or transfer other than is herein provided for.

21. NOTICES

Any notice, consent or communication permitted to be given or made under this Agreement shall be in writing and shall be deemed to have been duly given or made to You when delivered telephonically, via short message service (SMS) to your mobile phone number previously advised to the Bank, to Your last known place of business or sent by post/mail/email to Your last known address. This clause shall not apply to the service of the notice prescribed following a variation of the interest rate or fees applicable to this Facility.

22. ANTI BRIBERY AND CORRUPTION

The Parties to this Agreement shall comply with all applicable laws, statutes, regulations, policies and procedures relating to and governing antibribery and anti-corruption including but not limited to the Anti-Corruption Act 2009, and the Bank’s related policies and procedures. The Parties shall not engage in any activity, practice or conduct which would constitute an offence under the Act or policies. The Parties shall not, and shall procure that their employees, agents and sub- contractors do not offer, solicit or accept an inducement/advantage in connection with the service under this Agreement. Breach of this clause shall be deemed a material breach of this Agreement entitling the Bank to terminate the Agreement immediately.

23. DATA PROTECTION

23.1 The Parties will observe all applicable legal provisions on data protection and will collect, store and process personal data only if necessary, for the performance of this Agreement and to the extent legally permitted or where an express consent of the relevant affected person has been provided.

23.2 The Party acting as a data controller warrants that it complies with all applicable data protection and privacy laws in Uganda.

23.3 The Party acting as data processor, warrants to limit the processing of personal data to the extent legally permitted by the laws in Uganda.

23.4 If either Party submits Personal Information to the other Party on behalf of another person, then that Party confirms that it has authorization of the data owner to process their Personal Information.

24. DISPUTE RESOLUTION

24.1 The Bank and Borrower shall make every effort to resolve amicably by direct informal negotiation any disagreement or dispute arising between them.

24.2 If, after 14(fourteen) days from the commencement of such informal negotiations both Parties have been unable to resolve the dispute amicably, the matter shall be referred for Arbitration.